Gambling Winnings On Form 1040

Inrecent times, the number of people who travel to gambling centers orregions where gambling is a lucrative business is on the high side.Reno and some cities of Las Vegas welcome several travelers for thispurpose.

- Gambling Winnings Form 1040

- Is Gambling Winnings Reported On A 1040 Form

- Reporting Gambling Winnings On 2017 Form 1040

- Where Do I Put Gambling Winnings On Form 1040

- Gambling Winnings On Form 1040

However, it is pertinent that you report the full amount of your gambling winnings as “other income” on line 21 of form 1040 as stated by the IRS. Also, you must distinctly claim your allowable gambling losses.

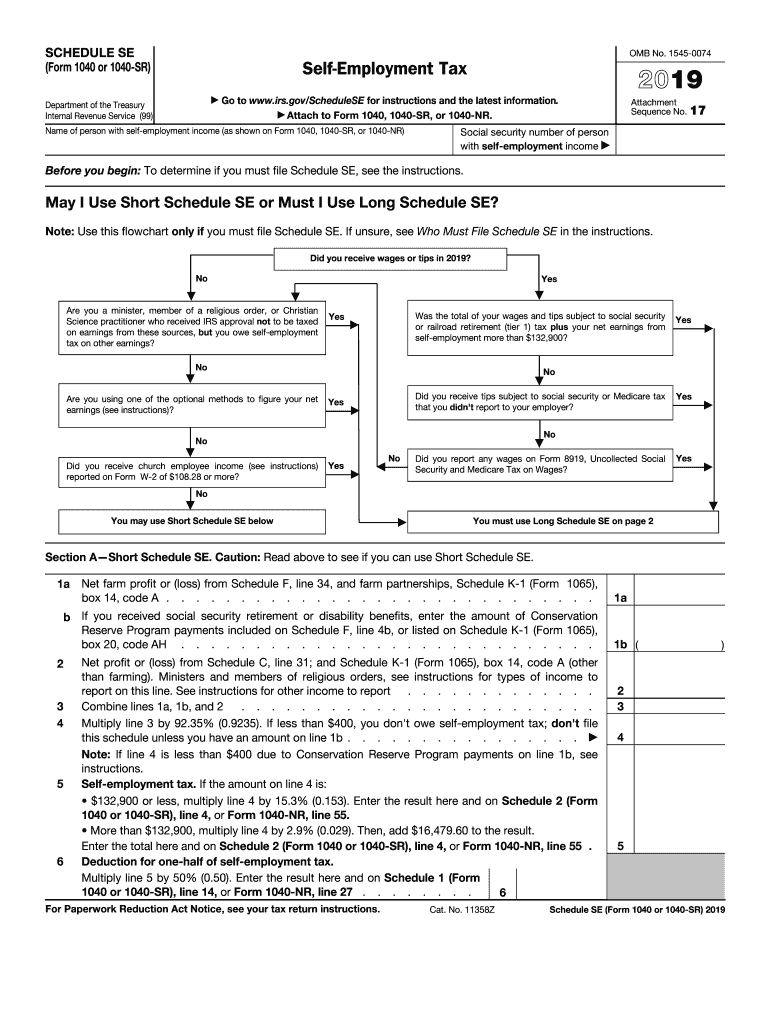

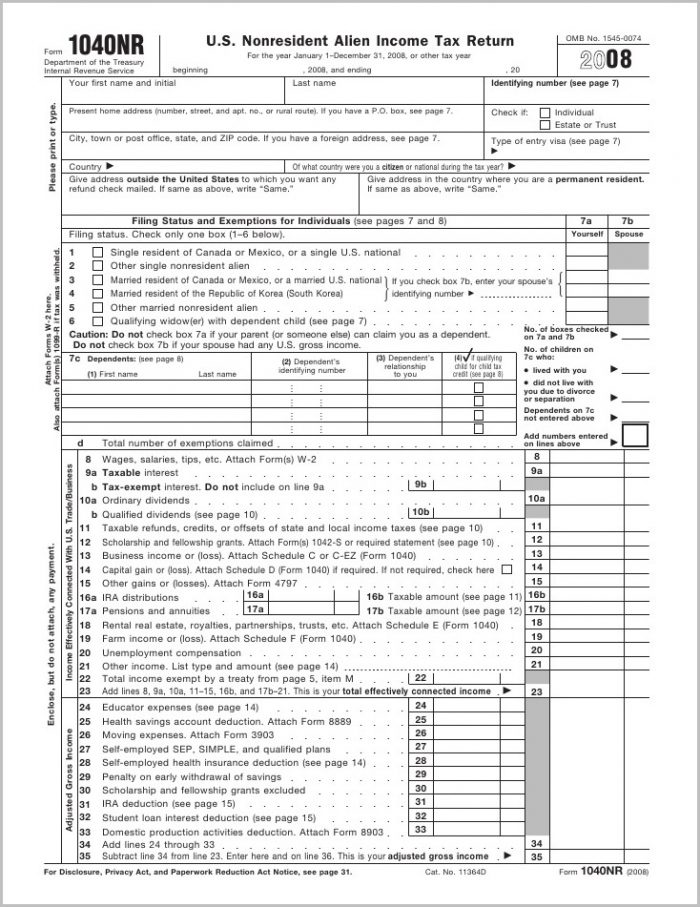

Whether it's $5 or $5,000, from an office pool or from a casino, all gambling winnings must be reported on your tax return as 'other income' on Schedule 1 (Form 1040), line 8. If you win a non-cash. When you file your taxes, you’ll report your gambling winnings as “Other Income” when you file with 1040.com. Amount of your gambling winnings and losses. Any information provided to you on a Form W-2G. The tool is designed for taxpayers who were U.S. Citizens or resident aliens for the entire tax year for which they're inquiring. Gambling Losses up to the Amount of Gambling Winnings You must report the full amount of your gambling winnings for the year on Schedule 1 (Form 1040), line 21. You deduct your gambling losses for the year on Schedule A (Form 1040), line 16. You can't deduct gambling losses that are more than your winnings. You can't reduce your gambling winnings.

Justso you know, if you win big while gambling, you do not get to keepevery cent to yourself. Now someone is asking, why? Well, gamblingwinnings are taxable! …it’s as simple as that!

So,just before you embark on any journey for the sole aim of gambling,take some lessons on tax laws relating to gambling and be sure tounderstand every piece of information you find therein just so youavoid the Internal Revenue Service (IRS) and its stress.

A little explanation of why gambling income is taxable.

Now,you’ll ask … “is gambling income taxable?” well, don’tstress it, the answer is not far- fetched!

Yes!Gambling income is taxable and just before the smiles on your facedisappears into thin air, there is good news for you as an earner…hang in there!

Unlikenormal income taxes, taxes placed on gambling are constant. That is,not progressive.

So,you have nothing to worry about. Be it winning a $3 million at thepoker table or $1500 at the slot machine. So, when you hit a big one,25% of your big win is to go to whichever game you play.

Plus,you will be provided with an IRS form which is also known as a W2-Gto enable you to report your earnings and winnings to the government.Keep in mind that this threshold depends on the type of game.

Anothersuitable question to ask is this, “do these games report theirgambling earnings? Definitely!

Aquick look at some examples; for specificity, in the casino, in orderfor your winnings to be reported, there is one inevitable thresholdthat should be declined.

Anotherexample is the slot machines; for winnings above $1200, it isrequired of you to report them.

Forthat of horse tracks, winnings that are greater than $600 or that are300 times your initial wager must be reported.

Gambling Winnings Form 1040

Thecase is not different for bingo as it is similar to the slot machine.Every winning from $1200 should be reported.

Thepoker tournament is no different as every winnings Greater than $5000must be reported.

Inspite of all these, it is not required of Casinos to hold taxes orissue a W2-G that was mentioned earlier in this article to playerswho win big amounts at some table games. For example, roulette,blackjack, craps.

Thereason for this kind of segregated requirement made by the IRS isunknown to us perhaps but known to them.

Froma well-observed point of view, in the table games, a level of skillis required whereas the slot machines are merely a game of chance.So, it is not expected of casinos to ascertain for sure the amountyou begin with when you cash in your chips from a table game.

Nowyou ask, “What happens when a W2-G is not sent to me or whathappens when I do not get a notification? Your question might also beasked in this form… What happens if my taxes are being withheldfrom blackjack winnings?

Beforeyou raise your hands high in the air while smiling thinking you canoutsmart all these, just a gentle reminder, not receiving a W2-G formor having withheld taxes does not relieve you of your duties toreport whatever is been won to the IRS.

Thenext question that should readily come to mind is “what should Ido in cases like this?” It’s simple! Do it yourself! You willsave yourself a whole lot of mess by filing your taxes alongside yourother taxes for the year rather than at the casino where you claimyour winnings.

Now,someone is saying, “oh! I’m a professional gambler, gambling iswhat I do for a living, mine is quite different, how do I report mytax?”

Ifgambling happens to be your real profession then, your revenue willbe tagged as regular earned income hence, it will be taxed at thenormal effective income tax rate of a taxpayer.

Keepin mind that your income and expenses compulsorily must be recordedon Schedule C, if you are self-employed.

Hereis a poser. Ever wondered if individual states tax gambling winnings?Well, to answer the poser, certainly, they do.

Insome states, it is required of gambling winners to claim theirwinnings in the state where they were won irrespective of your placeof domicile. Also, your state of residence will require you to reportyour winnings but, at the same time give a deduction for the taxesthat have already been paid in the non- resident state.

Seemslike we are missing out on something really important which happensto be our big question for this article.

Everthought of what will happen if you do not report your gamblingwinnings? Well, enough of the rambles and mumbles as your eye-rollinghas confirmed the answer. Well, we know it’s a “No” simplybecause when that thought crossed your mind, you waved it off withthe back of your hands.

But,guess what? Dust your rackets as we will be hitting off some balls ofquestions as regards that.

Itis quite easy to shrug off the idea of reporting your gamblingearnings whenever that thought creeps into mind because we all wantto enjoy our bucks without any external force trying to snatch itfrom us.

Sosad! Now might not be a perfect time to let that slide as you do notwant to get involved with the IRS. Bet it could get messier thanimagined.

Aswe all know that the most difficult thing in the world to understand,as stated by Albert Einstein, is the concept of income taxes.

Is Gambling Winnings Reported On A 1040 Form

However,it is pertinent that you report the full amount of your gamblingwinnings as “other income” on line 21 of form 1040 asstated by the IRS. Also, you must distinctly claim your allowablegambling losses.

Itis unknown to many that the IRS does not permit reducing or netting,gambling winnings by gambling losses and just reporting thedifference. Well, it is considered that such a person owes the IRSback taxes, interest and penalties.

Justso you know, gambling losses up to your winnings must be claimed asan itemized deduction on Schedule A, under the heading “othermiscellaneous deductions”. Where the problem lies is that asidesnetting, there are more than 65% of taxpayers who don’t itemize theirdeductions and can’t deduct gambling losses pay more tax on grosswinnings than they won.

Besides,losses accumulated from gambling cannot be moved forward tocounterbalance winnings in another year.

Incase you haven’t heard, the IRS takes a hard line on gambling income.Hence, in an audit, without providing enough documentation, the agentwill fail to believe you’re losing all winnings. That is, you musthave sufficient documentation to prove your loss so, keep your losingtickets alongside all other important documents you’ve got.

Whatwill a proper record-keeping require of you?

Aproper record-keeping will require a date, the type of gamblingactivity or wager, the name of the gambling establishment, theaddress of the gambling business and the number, list of peoplepresent with you plus the inevitable, amount won or lost.

Insome cases, it will be of utmost importance for you to keepsupplements hotel bills, gas cards, and airline tickets just to provethat they were not part of ATM gambling funds.

Sometimes,the IRS fails to take into consideration the credibility of the ATMreceipts forgetting that the ATM cash receipt could have been used topurchase the nondeductible like cinema bills, spa treatment, salon,restaurant meals.

So,we urge you to input all the ATM funds received to fund the gamblingsessions as evidence for your gambling records.

Keepin mind that the IRS kicks against the player’s reward card as it ismost times an ingenuine way to prove gambling loses because othergamblers have used the card.

Youridentity and evidence that you were the only one using the cardshould all be in your gambling records.

Yourgambling log is being supported and given credibility by document andwin-loss reports. So, put your journal to substantiate the player’scard at every gamble.

Inconclusion, we urge you to be careful just in case because manystatements do not provide substantiative evidence simply becauseestimates are being used. Also, do not hesitate to report every ofyour gambling winnings.

Cheers!

Reporting Gambling Winnings On 2017 Form 1040

Gamblers understand the concept of win some, lose some. But the IRS? It prefers exact numbers. Specifically, your tax return should reflect your total year’s gambling winnings – from the big blackjack score to the smaller fantasy football payout. That’s because you’re required to report each stroke of luck as taxable income — big or small, buddy or casino.

If you itemize your deductions, you can offset your winnings by writing off your gambling losses.

It may sound complicated, but TaxAct will walk you through the entire process, start to finish. That way, you leave nothing on the table.

How much can I deduct in gambling losses?

You can report as much as you lost in 2019 , but you cannot deduct more than you won. And you can only do this if you’re itemizing your deductions. If you’re taking the standard deduction, you aren’t eligible to deduct your gambling losses on your tax return, but you are still required to report all of your winnings.

Where do I file this on my tax forms?

Let’s say you took two trips to Vegas this year. In Trip A, you won $6,000 in poker. In the Trip B, you lost $8,000. You must list each individually, with the winnings noted on your return as taxable income and the loss as an itemized deduction in Schedule A. In this instance, you won’t owe tax on your winnings because your total loss is greater than your total win by $2,000. However, you do not get to deduct that net $2,000 loss, only the first $6,000.

Now, let’s flip those numbers. Say in Trip A, you won $8,000 in poker. In Trip B, you lost $6,000. You’ll report the $8,000 win on your return, the $6,000 loss deduction on Schedule A, and still owe taxes on the remaining $2,000 of your winnings.

What’s a W-2G? And should I have one?

Where Do I Put Gambling Winnings On Form 1040

A W-2G is an official withholding document; it’s typically issued by a casino or other professional gaming organization. You may receive a W-2G onsite when your payout is issued. Or, you may receive one in the mail after the fact. Gaming centers must issue W-2Gs by January 31. When they send yours, they also shoot a copy to the IRS, so don’t roll the dice: report those winnings as taxable income.

Don’t expect to get a W-2G for the $6 you won playing the Judge Judy slot machine. Withholding documents are triggered by amount of win and type of game played.

Expect to receive a W-2G tax form if you won:

- $1,200 or more on slots or bingo

- $1,500 or more on keno

- $5,000 or more in poker

- $600 or more on other games, but only if the payout is at least 300 times your wager

Tip: Withholding only applies to your net winnings, which is your payout minus your initial wager.

What kinds of records should I keep?

Gambling Winnings On Form 1040

Keep a journal with lists, including: each place you’ve gambled; the day and time; who was with you; and how much you bet, won, and lost. You should also keep receipts, payout slips, wagering tickets, bank withdrawal records, and statements of actual winnings. You may also write off travel expenses associated with loss, so hang on to airfare receipts.

Use TaxAct to file your gambling wins and losses. We’ll help you find every advantage you’re owed – guaranteed.