Gambling Winnings 1040 Line 21

- Gambling Winnings 1040 Line 21 Instructions

- Gambling Winnings 1040 Line 21 Form

- Gambling Winnings 1040 Line 21 Schedule

Gambling Winnings 1040 Line 21 Instructions

Recently I was asked to review a return for a new client. He is a professional gambler and he wanted to make sure his previous tax preparer entered the information correctly. This gave me a perfect opportunity to present a case study to compare the differences between reporting as a person who gambles a few times a year with a person whose main activity during the year is gambling as a professional.

Non-Professional Vs Professional Gambler

Gambling Winnings 1040 Line 21 Form

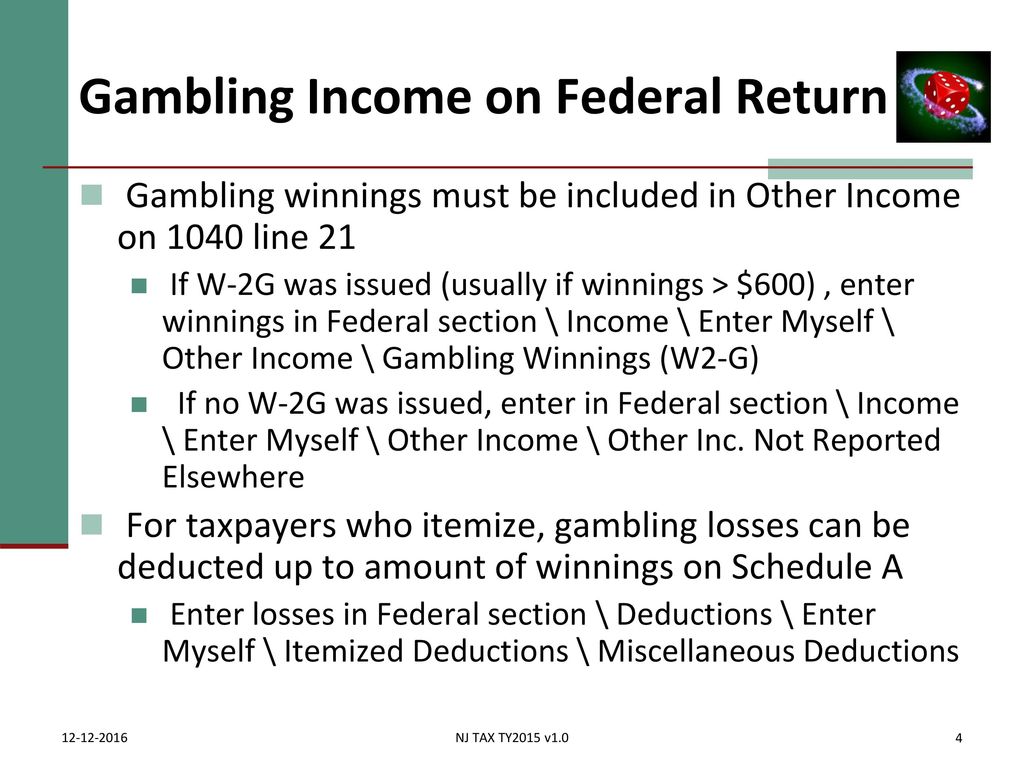

A non-professional gambler receives a W2G from the casino and the reported winnings will flow to Line 21 - Other Income on the Schedule 1 of the 1040. The amount of losses can be taken on the Schedule A Line 16. This deduction is limited to the amount of winnings. Also, the non-professional is not allowed to deduct travel, auto or other expenses related to the gambling activity.

- Other income is reported on line 8 of Schedule 1 of the 2020 Form 1040, then the total from line 9 of Schedule 1 is transferred to line 8 of the 1040 itself. These lines pertain to forms for the 2020 tax year, the return you'd file in 2021.

- Gambling income includes, but is not limited to, winnings from lotteries, casino, raffles, sweepstakes, horse races and other sports betting. The taxable value is generally the cash winnings (minus the wager, bet or buy-in) and the fair market value of tangible property won (e.g. Cars and vacations). All gambling winnings are recorded on Line 21 (“Other Income”) of your Form 1040 individual tax return.

- Use Form 1099G to report your gambling losses on your federal income tax return. The IRS mails this form no later than Jan. It shows the total amount of your gambling winnings, which you must claim on Form 1040, line 21. Obtain Schedule A, the itemized deductions form for your federal income tax return.

The professional gambler also receives W2G forms, and in many cases, large numbers of W2Gs. When these are entered on the 1040, they are attached to the Schedule C for self employment. With the Schedule C, the taxpayer would be able to deduct resonable travel expenses, auto expenses and of course, the gambling losses - with the same deduction limitation. He would also be able to deduct his Self-Employment Heath Insurance and other deductions related to his business. Another benefit from the Schedule C is that the QBI could potentially give the taxpayer an additional 20% decution.

The full amount of your gambling winnings for the year must be reported on line 21 of IRS Form 1040. You may not use Form 1040A or 1040EZ This rule applies regardless of the amount and regardless of whether you receive a Form W-2G or any other reporting form. Gambling Winnings & Losses. Gambling winnings are reported as Other Income on Line 21 of IRS Form 1040. While you may be able to deduct your gambling losses, gambling winnings are not directly offset by gambling losses in your tax return. You must be able to itemize deductions on Schedule A of your return in order to deduct the gambling losses, and then can only deduct an amount up to the amount of your gambling winnings.

But there is a catch. The total amount of expense deduction on the Schedule C cannot exceed the total amount of winnings and must show that the majority of the income came from gambling.

Outcome of the Review

Gambling Winnings 1040 Line 21 Schedule

When I reviewed his return, I did find a few errors his previous tax preparer made. The taxpayer had almost 200 W2Gs. The tax preparer had mistakenly marked five of the W2Gs to flow to Line 21 - not the Schedule C. This caused the taxpayer to pay a substantial tax payment in error. I amended the return and my new client recently received his refund check from the IRS.